Arvith

India’s financial technology sector has experienced rapid innovation in recent years, but few systems have combined automation, accessibility, and mass appeal quite like Arvith. Founded by Indian entrepreneurs and backed by a government-supported initiative, Arvith aims to simplify wealth creation through a fully automated process that requires minimal user input.

The system’s promise is clear: start with ₹21,000 and watch daily profits flow directly into your bank account. For a growing base of users across India, that promise is being realized.

A Model Designed for Inclusion

At its foundation, Arvith is about reducing barriers. Unlike many financial tools that demand technical knowledge or constant monitoring, this system is built for simplicity. Users initiate their journey with a one-time investment of ₹21,000. After that, the system begins automated daily payouts to their registered bank accounts.

No trading knowledge is required. No manual withdrawal steps are involved. For many Indians previously excluded from active wealth-building opportunities, this structure is a breakthrough.

Arvith’s design aligns with a national push for digital inclusion, especially in rural and semi-urban areas where access to sophisticated financial tools has traditionally been limited. By operating within the framework of Indian banking infrastructure, the system enhances trust and usability.

Automation at the Core

The appeal of Arvith lies in its consistent, automated functionality. Once a user is registered, the system manages everything from profit generation to direct bank transfers, without requiring user action.

This automation is not just a convenience. It forms the backbone of the system’s value. By removing manual steps and uncertainty, Arvith creates a user experience that is both seamless and dependable. The emphasis on scheduled daily transfers ensures transparency and gives users a tangible sense of progress.

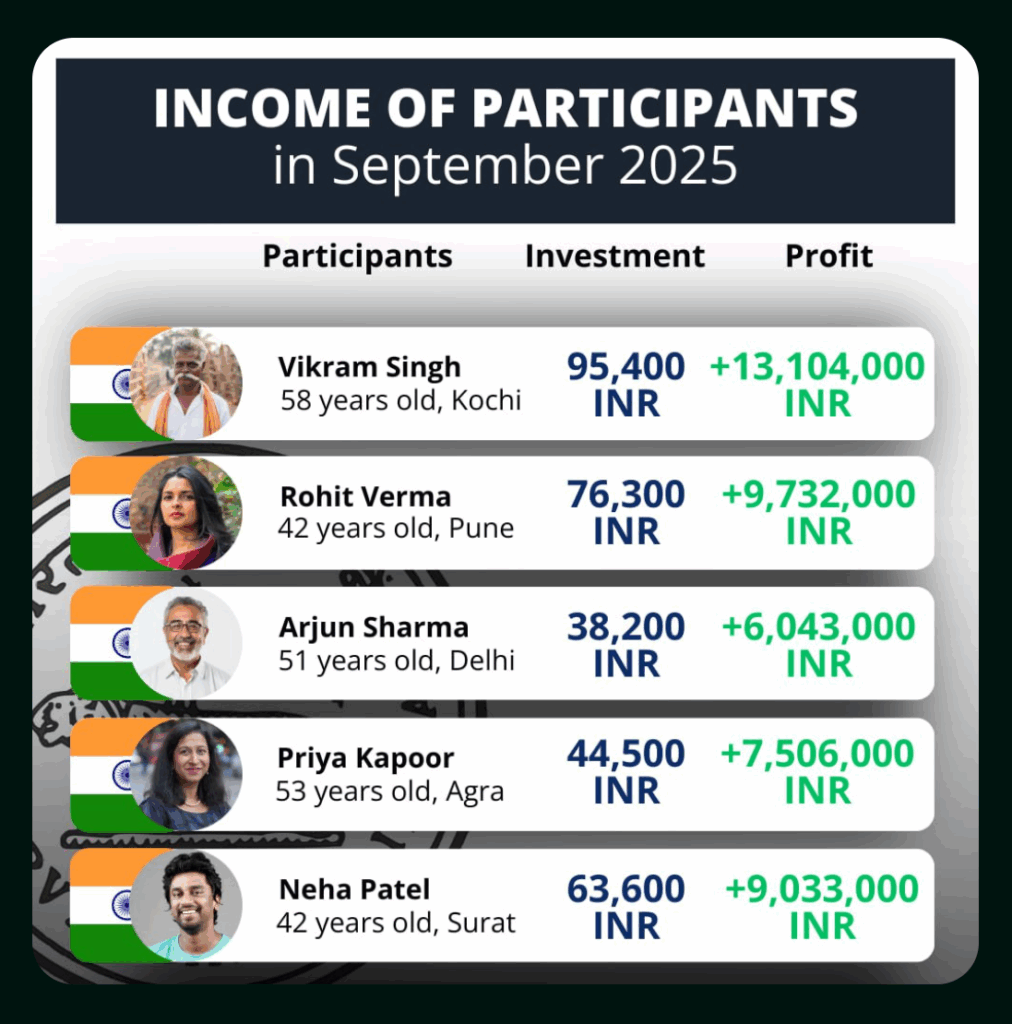

Reports of users earning over ₹10 lakh in the first month may not reflect the average experience, but they do illustrate the system’s high-end potential under ideal conditions. Crucially, these returns are processed through verifiable bank transactions, adding a layer of credibility to user claims.

A System Scaling Nationally

With over 100,000 users across India, Arvith is no longer a startup experiment. It has reached a level of adoption that suggests operational maturity and scalability.

Its user demographic is diverse, ranging from first-time investors in Tier 2 cities to digital-savvy professionals in metro areas. This widespread reach reinforces the idea that Arvith’s simplicity is not just a feature, but a strategic advantage.

Unlike complex investment tools that segment audiences by expertise or capital, Arvith maintains a single-entry threshold and a uniform experience. That consistency contributes to its growth and makes it suitable for national scale.

Legitimacy and Government Endorsement

Questions about legitimacy are common with any high-return system, and rightfully so. What sets Arvith apart is its transparent ecosystem and government-aligned mission.

The system is built and operated by Indian entrepreneurs and supported by a government initiative aimed at expanding financial participation. While it is not a registered financial institution, it does not exhibit typical red flags associated with scams. There is no referral pressure, no offshore payment gateways, and no anonymous leadership.

This alignment with public digital goals provides users with a higher level of confidence than most private, unregulated offerings.

Conclusion: Arvith Delivers What It Promises

In a space filled with technical jargon and overcomplicated products, Arvith brings clarity. It delivers a single-use case: automated daily profits. And it executes that efficiently, securely, and at scale.

It is not a miracle engine, nor is it without risk. But it is a serious, nationally focused solution that has made financial growth accessible for tens of thousands of Indians.

For those seeking an automated, homegrown alternative to traditional investment tools, Arvith presents a compelling option. Its real value lies not just in high returns, but in rethinking who gets to participate in wealth creation, and how.